Forum: DCForumID6

Thread Number: 32093

[ Go back to previous page ]

Original Message

"Tax Deductions for Children"

Posted by weltek on 09-05-08 at 01:14 PM

This issue has come up among our POTUS nominees. I'm curious how others feel about it. Both candidates, from my understanding, support increasing the amount of deduction per child a family can take.As a childless taxpayer, I pay property and income taxes to support other's children, and as proposed, they'd keep paying fewer and fewer taxes the more children they have. I know today's children will be the workforce and sustainers of my generation, and thus I believe an investment in their education is important. I will happily pay taxes to support our educational system and other needs based programming.

I have issue with raising the deduction families with children receive, though. I believe having children is taken too financially lightly in this country. The attitude of "you will never have enough money, so do it now" has fed into having the big house, the shiny car, then kids....then a parent deciding to stay home, not being able to afford the mortgage or the car, defaulting on loans, etc. and feeding into a difficult cycle.

I've also seen the same situation work tremendously well, whether by having one spouse with a good paying job, the SAHP finding ways to be frugal, and sometimes moving and downsizing cars, etc. to be able to afford it.

I know many that look at the huge tax return as their "time to catch up on bills I'm three months behind on," and then they get back into the same debt in six months. It's not making their lives more affordable, it's providing a predictable, short-term catch up in many instances. Thus, I don't think higher deductions will solve any problems long term. It's kind of like suspending the gas tax...a gimmick that puts a band-aid on the problem.

I'd love to hear other's thoughts and experiences. I know many here have gone through raising young ones while making tough job decisions. How do you rely or not rely on that deduction? What difference in your life does it make?

Table of contents

- RE: Tax Deductions for Children,J I M B O, 01:31 PM, 09-05-08

- RE: Tax Deductions for Children,dabo, 02:16 PM, 09-05-08

- RE: Tax Deductions for Children,syren, 03:17 PM, 09-05-08

- RE: Tax Deductions for Children,Karchita, 02:24 PM, 09-05-08

- RE: Tax Deductions for Children,weltek, 02:27 PM, 09-05-08

- RE: Tax Deductions for Children,Karchita, 02:31 PM, 09-05-08

- RE: Tax Deductions for Children,frodis, 02:33 PM, 09-05-08

- RE: Tax Deductions for Children,weltek, 02:56 PM, 09-05-08

- RE: Tax Deductions for Children,brvnkrz, 06:41 PM, 09-05-08

- RE: Tax Deductions for Children,Karchita, 00:07 AM, 09-06-08

- RE: Tax Deductions for Children,brvnkrz, 06:41 PM, 09-05-08

- RE: Tax Deductions for Children,weltek, 02:56 PM, 09-05-08

- RE: Tax Deductions for Children,weltek, 02:27 PM, 09-05-08

- RE: Tax Deductions for Children,Ahtumbreez, 02:26 PM, 09-05-08

- RE: Tax Deductions for Children,weltek, 02:27 PM, 09-05-08

- RE: Tax Deductions for Children,Prof_ Wagstaff, 03:31 PM, 09-05-08

- RE: Tax Deductions for Children,Dizwiz, 06:31 PM, 09-05-08

- RE: Tax Deductions for Children,Max Headroom, 02:43 PM, 09-05-08

- RE: Tax Deductions for Children,cahaya, 03:11 PM, 09-05-08

- RE: Tax Deductions for Children,weltek, 03:17 PM, 09-05-08

- RE: Tax Deductions for Children,cahaya, 03:11 PM, 09-05-08

- RE: Tax Deductions for Children,syren, 03:15 PM, 09-05-08

- RE: Tax Deductions for Children,weltek, 03:26 PM, 09-05-08

- RE: Tax Deductions for Children,cahaya, 03:37 PM, 09-05-08

- RE: Tax Deductions for Children,syren, 03:39 PM, 09-05-08

- RE: Tax Deductions for Children,cahaya, 00:52 AM, 09-06-08

- RE: Tax Deductions for Children,syren, 07:52 AM, 09-06-08

- RE: Tax Deductions for Children,cahaya, 00:52 AM, 09-06-08

- RE: Tax Deductions for Children,syren, 03:39 PM, 09-05-08

- RE: Tax Deductions for Children,syren, 03:37 PM, 09-05-08

- RE: Tax Deductions for Children,sharnina, 03:39 PM, 09-05-08

- RE: Tax Deductions for Children,weltek, 09:06 AM, 09-08-08

- RE: Tax Deductions for Children,cahaya, 03:37 PM, 09-05-08

- RE: Tax Deductions for Children,weltek, 03:26 PM, 09-05-08

- RE: Tax Deductions for Children,samboohoo, 04:10 PM, 09-05-08

- Children are an important part,IceCat, 00:20 AM, 09-06-08

- RE: Children are an important part,newsomewayne, 10:21 AM, 09-08-08

- RE: Tax Deductions for Children,bondt007, 00:46 AM, 09-06-08

- RE: Tax Deductions for Children,geg6, 10:22 AM, 09-06-08

- RE: Tax Deductions for Children,PagongRatEater, 09:35 AM, 09-08-08

- doubletake!,dabo, 09:47 AM, 09-08-08

- RE: doubletake!,PagongRatEater, 10:16 AM, 09-08-08

- RE: doubletake!,dabo, 12:16 PM, 09-08-08

- RE: doubletake!,PagongRatEater, 10:16 AM, 09-08-08

- doubletake!,dabo, 09:47 AM, 09-08-08

- RE: Tax Deductions for Children,PagongRatEater, 09:35 AM, 09-08-08

Messages in this discussion

"RE: Tax Deductions for Children"

Posted by J I M B O on 09-05-08 at 01:31 PM

This seems to be another of those issues where people can get stuck arguing the extremes, when in reality we need to talk about where "in the spectrum" of all or nothing the final balance should be found.As a parent, I see how an argument can be made around a higher level of spending with kids. Better for the economy right? Add in the intangibles you mentioned. On the other hand, there *must* be a point at which child deductions create an imbalance.

My only concern about what the candidates are saying is whether they want it based on sound logic/reason, or if it is a simple pander to buy votes. In the end, I guess I don't know what it should be. I do know that the taxes we pay are not managed effectively. That's the bigger problem IMO.

"RE: Tax Deductions for Children"

Posted by dabo on 09-05-08 at 02:16 PM

LAST EDITED ON 09-05-08 AT 02:17 PM (EST)I had no issue paying my taxes before I was a parent, knowing I was helping out people with children on things like eductation; as long as I got the benefits of the roads being kept in repair and so on that were beneficial to me I was okay with that. The deductions I have received for my dependant children since becoming a parent have helped out.

Notably, though, over the years the cost of parenting has risen considerably, and the tax breaks haven't kept up. The schools do try to keep the cost of lunch reasonable, some things haven't gotten bad; but other things like daycare etcetera have increasingly become family budget busters.

"RE: Tax Deductions for Children"

Posted by syren on 09-05-08 at 03:17 PM

Childcare costs are a reason why I am not working. I have to find a job that at least covers that, and I haven't. The last job I had since we have been married, after childcare costs we were actually paying for me to go to work instead of it bringing in a little income.

"RE: Tax Deductions for Children"

Posted by Karchita on 09-05-08 at 02:24 PM

As an environmentalist, I would like to see our government encourage people to have fewer children, not more.This is absolutely nothing personal against people who chose to have large families, but I don't think it is good for the planet.

"RE: Tax Deductions for Children"

Posted by weltek on 09-05-08 at 02:27 PM

My MIL was not impressed when I used this argument in retort to her calling us selfish for NOT having children. Nothing in that vein impresses her enough to quit harassing us about it. Every year, we still get mother's day and father's day gifts from her, as her "future grandchildren's mom & dad."

"RE: Tax Deductions for Children"

Posted by Karchita on 09-05-08 at 02:31 PM

Unless she gives you really good stuff, maybe you should try telling her that silly, ceremonial giftgiving is also not good for the planet.

Yes, I know I am a troublemaker.

"RE: Tax Deductions for Children"

Posted by frodis on 09-05-08 at 02:33 PM

Every year, we still get mother's day and father's day gifts from her, as her "future grandchildren's mom & dad."Um. That's insane.

Are they good gifts?

"RE: Tax Deductions for Children"

Posted by weltek on 09-05-08 at 02:56 PM

Given that it's stupid crap, I would usually favor Karchita's answer. However, it's often stuff (useless crap) from rummage sales, etc.

"RE: Tax Deductions for Children"

Posted by brvnkrz on 09-05-08 at 06:41 PM

Save them, rewrap them and give them back to them the following year as their mother's and father's day gifts.

An Arkie original.

"RE: Tax Deductions for Children"

Posted by Karchita on 09-06-08 at 00:07 AM

Troublemaker.

"RE: Tax Deductions for Children"

Posted by Ahtumbreez on 09-05-08 at 02:26 PM

I miss my child deductions. That is all.

Agman took me to the islands

"RE: Tax Deductions for Children"

Posted by weltek on 09-05-08 at 02:27 PM

Fair enough.

"RE: Tax Deductions for Children"

Posted by Prof_ Wagstaff on 09-05-08 at 03:31 PM

I miss the closer parking spaces.

Surfkitten Summer Sigshop 2008

"RE: Tax Deductions for Children"

Posted by Dizwiz on 09-05-08 at 06:31 PM

Troublemaker.

"RE: Tax Deductions for Children"

Posted by Max Headroom on 09-05-08 at 02:43 PM

I like tax deductions for my children.Parenting has gotten more expensive, so I support an increase in the deductions. I agree that there's a tipping point where deductions become too large, but we're not there yet.

Headbanger by IceCat, siggie by agman

"RE: Tax Deductions for Children"

Posted by cahaya on 09-05-08 at 03:11 PM

Parenting has gotten more expensiveI wondered just how expensive.

It seems to partly depend on how many parents/guardians in the household, income, geography and other factors.

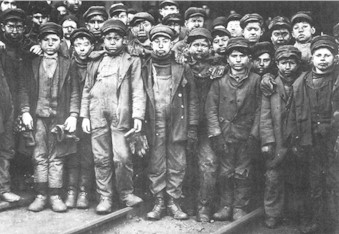

Here's a cost table based on USDA guidelines.

Here's a calculator.Yikes! With just two kids, that comes to between a quarter and a half million dollars! And I do appreciate the tax benefit that helps offset a very small fraction of this cost.

"RE: Tax Deductions for Children"

Posted by weltek on 09-05-08 at 03:17 PM

Thanks,cahaya, for those links.And to be clear, I do clearly believe parenting our next generation is a noble undertaking, and a financial undertaking, too.

"RE: Tax Deductions for Children"

Posted by syren on 09-05-08 at 03:15 PM

LAST EDITED ON 09-05-08 AT 03:19 PM (EST)For me I see it the same as the property tax deduction, if you have it then you get the deductions. Home interest is tax deductible, and so is education expenses. We used both this year, but those people who choose not have a home that they are paying for do not get it. Neither do the people who are not paying for school. They are all huge financial responsibilities that society as a whole benefits from.

Now when I was a single parent I did receive the earned income tax credit, which is in effect another deduction. I also received the child tax credit. Both were not only based on having a child, but also my income for family size. Yes, I did rely on them. Yes, I did need them. Normally most of my refund went to clothing for syrenboy, or repairs to my old truck. However, I can honestly say that had syrenboys father paid the child support that was court ordered I would have not needed it.

And that brings me to something I think is related to this, because it involves tax payers money. If I were without children, for whatever reason, I would be most upset about parents who do not pay child support. About it not being enforced. It is tax payers money that helps pick up that tab, in more ways than just welfare or tax credits. Because I know that the amount I received in credits was less than the amount I would have received if the court order had been enforced. I know that if he was paying now, that it would be more than the additional they are proposing to add to the child deduction.

I would be more upset or questioning the parents who repeatedly buck the system, and you picking up their tab. Of the employers who pay them under the table so they don't have to pay, and you pick up the tab. Maybe if those orders were enforced there would be less need for credits or even welfare. you is a general term, not you as in cheesy.

ETA:words I left out while trying to take care of the baby while typing without looking. I did not mean to say children were like property. Just that the deductions were similar.

"RE: Tax Deductions for Children"

Posted by weltek on 09-05-08 at 03:26 PM

LAST EDITED ON 09-05-08 AT 03:27 PM (EST)Good point about the other taxes. I think deducting property taxes paid is a bit silly, but we are guilty of it. I know not all states allow this, but WI does. I frankly think renters and homeowners should pay a tax (such as property tax) to pay for roads, schools, etc. I've never been entirely clear why renters don't have to shoulder any of that burden. One could argue homeowners have more money than renters, I suppose, and thus homeowners should have the greater burden to support these things. If that is true, I won't argue.

I think education expesnes is a reasonable way to equalize opportunity, in a way. I definitely look at home ownership and higher education as two different things. Home ownership is never necessary, yet education will increase your chances of finding greater financial independence.

FWIW, I hate child support dodgers, but I don't think it's a 'this or that' debate. I think it might be a "where to put the effort" issue, but with both candidates putting raising the deduction no the table, I wanted to talk about this specific point.

"RE: Tax Deductions for Children"

Posted by cahaya on 09-05-08 at 03:37 PM

I frankly think renters and homeowners should pay a tax (such as property tax) to pay for roads, schools, etc. I've never been entirely clear why renters don't have to shoulder any of that burden. One could argue homeowners have more money than renters, I suppose, and thus homeowners should have the greater burden to support these things. If that is true, I won't argue.Property tax is factored into the monthly lease/rent anyway. I know that the owner of the house I lease now wanted to increase the rent an additional $100 more than what the previous tenant paid to cover the increase in property tax. I managed to negotiate the rent to what the previous tenant paid (without the increase), but I understood why my house owner wanted to increase it.

"RE: Tax Deductions for Children"

Posted by syren on 09-05-08 at 03:39 PM

Oh...I meant to say also that they are trying to do away with the county property tax here, and have another penny tax. I think it is a great idea, because home owners are no longer paying it by themselves but everyone, including illegal immigrants, are paying.

"RE: Tax Deductions for Children"

Posted by cahaya on 09-06-08 at 00:52 AM

Just curious what you mean by the penny tax. Is it a residence tax for anyone who lives within the county, regardless of ownership of their residence? Or is it like a local sales tax? And who gets exempted, if anyone, like the unemployed?

syren's light

"RE: Tax Deductions for Children"

Posted by syren on 09-06-08 at 07:52 AM

We actually have a couple of penny taxes here in addition to our sales tax. As far as I know, no one is exempt from the penny tax. It has funded our county pools, parks, and greenspace. I am supporting the property tax being reduced dramatically or cut altogether in place of the additional penny tax.

"RE: Tax Deductions for Children"

Posted by syren on 09-05-08 at 03:37 PM

I am sorry. I was just pointing out from my personal situation, that the issue of deductions and credits might not be so big if other things were correctly enforced.I understand you want to discuss that specific point, but the picture is bigger than that, because the majority of people who really benefit from things like the child tax credits, EIC, and additional child deduction are the lower income single family households.

Is the deduction a standard you have a child deduction, or is it based on income as well? If it is the first then I think it will certainly help a lot of families struggling out there. If it is the second then I think other things need to be looked at and fixed before another credit is in place.

"RE: Tax Deductions for Children"

Posted by sharnina on 09-05-08 at 03:39 PM

Renters don't pay property taxes because they don't own the property. The owners of the rentals pay property taxes (which is probably figured into the renters cost).

GUESS WHAT! I got a FEV-ah -- and the only pre-SCRIP-tion

-- is MORE COWBELL!

"RE: Tax Deductions for Children"

Posted by weltek on 09-08-08 at 09:06 AM

I meant that I don't understand why property owners shoulder the burden of keeping up roads, schools, etc. I understand why Renter's don't pay property taxes, but I think they should share in some kind of tax, be it of a different name.However, as cahya and you point out, those costs are passed along in the form of increased rent, etc. So yeah, nevermind my mini rant.

"RE: Tax Deductions for Children"

Posted by samboohoo on 09-05-08 at 04:10 PM

I believe having children is taken too financially lightly in this country.I absolutely and 100% agree with you on this. There is such a big picture out there and far too many people don't even glance at it, much less look at the big picture.

I also agree with what Max and Cahaya said down below about the cost increasing. I have seen the cost of my daycare bill rise each year with the deductable staying the same each year.

"Children are an important part"

Posted by IceCat on 09-06-08 at 00:20 AM

... of The Right's plans to make the US economy be able to compete with Chinese in the 21st century "fair market" economy.

"RE: Children are an important part"

Posted by newsomewayne on 09-08-08 at 10:21 AM

I don't see a smiley, but I surely hope that that is supposed to be a joke.

U.S. Government: Doing everything you used to do yourself for you since 2008.

"RE: Tax Deductions for Children"

Posted by bondt007 on 09-06-08 at 00:46 AM

I haven't read all of the thread yet - all I know is - they get more and more expensive! I'll take the increase and run...

>Issued by "Q" and RollDdice

Charter Member, April 2001; Club Anti-DAW

"RE: Tax Deductions for Children"

Posted by geg6 on 09-06-08 at 10:22 AM

One big fat deduction per household for the first child and not a penny more for every one thereafter.

Enough. Barack Obama 8-28-08

"RE: Tax Deductions for Children"

Posted by PagongRatEater on 09-08-08 at 09:35 AM

I could actually get on board with this. I would prefer it to be two, but the tax code should not be geared to reward big families any more than the welfare system shouldn't be ginned up to encourage baby mommas.

No leadership or major legislation to speak of...But he's never run a city, never run a state, never run a business. He's never had to lead people in crisis. This is not a personal attack....it's a statement of fact - Barack Obama has never led anything. Nothing. Nada.

Rudy Guiliani

"doubletake!"

Posted by dabo on 09-08-08 at 09:47 AM

What??? Social engineering via tax codes to promote one-child or two-child families, that would be okay with you? I'm genuinely stunned at that, PRE, not kidding, genuinely stunned.Could there at least be some allowance made for cases of multiple births?

ARRRRRRR!!!!

"RE: doubletake!"

Posted by PagongRatEater on 09-08-08 at 10:16 AM

I think that the centerpiece of American society is the family, so I have no problem with the tax code recognizing the cost of having a family and the beneficial neighborhood effects of that. However, when you get into the area of having 5, 6, 7 kids that needs to be a burden that you take on yourself as there isn't, I don't believe, any incremental benefit to society at that point. I also would say that there are probanly diminishing marginal costs to multiple children.IF people want large families, I think that's great. I just don't think that needs to be subsidized by the taxpayer.

BTW, as I understand it, the tax code today caps you at 2 kids for deduction.

"RE: doubletake!"

Posted by dabo on 09-08-08 at 12:16 PM

I looked around at many tax sites and found no reference to a two-child cap. One site had a table for claimed exemptions (including self and spouse if filing jointly) which went up to 10. But of course all that those exemptions accomplish is reducing the amount af taxable income that must be claimed, the actual reduction in taxes is less than the figures imply. There are caps on how much of one's income can be exempted, perhaps that is what you are thinking of? If, however, you can provide a link to a site I didn't find, please and thank you.